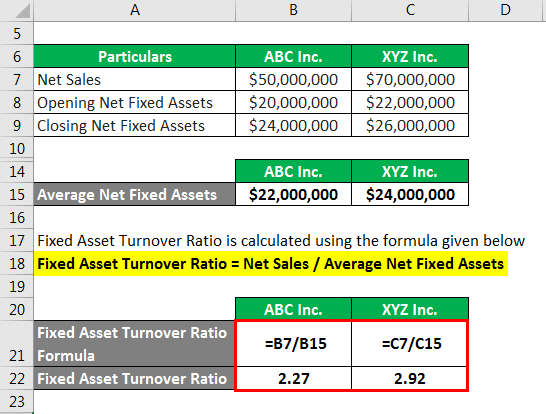

Start by determining the total revenue generated by your company over the last year. Next, determine the value of your fixed assets, including both tangible and intangible assets. Finally, divide the total revenue by the value of the fixed assets to obtain the fixed asset turnover ratio. The fixed asset turnover ratio formula divides a company’s net sales by the value of its average fixed assets. With this fixed asset turnover ratio calculator, you can easily calculate the fixed asset turnover (FAT) of a company.

Company

There are a few outside factors that can also contribute to this measurement. InvestingPro offers detailed insights into companies’ Fixed Asset Turnover including sector benchmarks and competitor analysis. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies. This way, a fixed asset is turned into a service and becomes a variable asset. It is not only an accounting technique but could also bring additional benefits to the business, like easier scaling of the company.

Limitations Of Fixed Asset Turnover Ratio

For Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 PP&E balances ($85m and $90m), which comes out to a ratio of 3.4x. For the final step in listing out our assumptions, the company has a PP&E balance of $85m in Year 0, which is expected to increase by $5m each period and reach $110m by the end of the forecast period. She has years of experience in SEO-optimized content creation and focuses on personal finance, investing and banking. Companies with a higher FAT ratio are often more efficient than companies with a low FAT ratio. By using a wide array of ratios, you can be sure to have a much clearer picture, and therefore a more educated decision can be made.

Does high fixed asset turnover means the company is profitable?

The asset turnover ratio is a key component of DuPont analysis, a system that the DuPont Corporation began in the 1920s to evaluate performance across corporate divisions. The first step of DuPont analysis breaks down return on equity (ROE) into three components, including asset turnover, profit margin, and financial leverage. Conversely, if a company has a low asset turnover ratio, it means it is not efficiently using its assets to create revenue. A system that began being used during the 1920s to evaluate divisional performance across a corporation, DuPont analysis calculates a company’s return on equity (ROE). On the other hand, company XYZ, a competitor of ABC in the same sector, had a total revenue of $8 billion at the end of the same fiscal year.

Fixed Asset Turnover Ratio

- The ratio is typically calculated on an annual basis, though any time period can be selected.

- Such efficiency ratios indicate that a business uses fixed assets to efficiently generate sales.

- When comparing the asset turnover ratio between companies, ensure the net sales calculations are being pulled from the same period.

- As with all financial ratios, a closer look is necessary to understand the company-specific factors that can impact the ratio.

The standard asset turnover ratio considers all asset classes including current assets, long-term assets, and other assets. A high ratio indicates that a company is effectively using its fixed assets to generate sales, reflecting operational efficiency. Conversely, if the value is on the other side, it indicates that the assets are not worth the investment. The company should either replace such assets and look for more innovative projects or upgrade them so as to align them with the objective of the business. A technology company like Meta has a significantly smaller fixed asset base than a manufacturing giant like Caterpillar. In this example, Caterpillar’s fixed asset turnover ratio is more relevant and should hold more weight for analysts than Meta’s FAT ratio.

Analyzing the specific factors affecting asset turnover in each situation is important. Comparing a company’s ratio to industry peers or historical performance can help determine what is considered good national real tax tracking company profile within a specific context. The denominator of the formula for fixed asset turnover ratio represents the average net fixed assets which is the average of the fixed asset valuation over a period of time.

The ratio is commonly used as a metric in manufacturing industries that make substantial purchases of PP&E to increase output. Investors monitor this ratio in subsequent years to see if the company’s new fixed assets reward it with increased sales. Over time, positive increases in the fixed asset turnover ratio can serve as an indication that a company is gradually expanding into its capacity as it matures (and the reverse for decreases across time). This ratio helps assess the efficiency of asset utilization and provides insights into how well the company is converting its fixed assets into revenue. You can also check out our debt to asset ratio calculator and total asset turnover calculator to understand more about business efficiency. After understanding the fixed asset turnover ratio formula, we need to know how to interpret the results.

Outsourcing would maintain the same amount of sales and decrease the investment in equipment at the same time. Investors and creditors use this formula to understand how well the company is utilizing their equipment to generate sales. This concept is important to investors because they want to be able to measure an approximate return on their investment. This is particularly true in the manufacturing industry where companies have large and expensive equipment purchases. Creditors, on the other hand, want to make sure that the company can produce enough revenues from a new piece of equipment to pay back the loan they used to purchase it. Its true value emerges when compared over time within the same company or against competitors in the same industry.

A high asset turnover ratio indicates a company that is exceptionally effective at extracting a high level of revenue from a relatively low number of assets. As with other business metrics, the asset turnover ratio is most effective when used to compare different companies in the same industry. Average total assets are found by taking the average of the beginning and ending assets of the period being analyzed.

Investors and creditors have to be conscious of this fact when evaluating how well the company is actually performing. Companies can improve this ratio by increasing sales without a proportionate increase in fixed assets or by efficiently managing and utilizing their existing assets. The higher the FAT ratio, the more efficiently the company utilizes fixed assets to grow revenue. The fixed assets include property, plant, and equipment (PP&E) but not cash or inventory. Therefore, the above are some criterias that indicate why it is important to assess the fixed asset turnover ratio in any business.