Purchase Returns and Allowances is a contra account and is used to reduce Purchases. Between the two accounting systems, there are differences in how you update the accounts and which accounts you need. In a perpetual system, the software is continuously updating the general ledger when there are changes to the inventory. In the periodic system, the software only updates the general ledger when you enter data after taking a physical count.

Cost Flow Assumption Diagram

However, perpetual systems require your staff to perform regular recordkeeping. For example, in a periodic system, when you receive a new pallet of goods, you may not count them and enter them into stock until the next physical count. In a perpetual system, you immediately enter the new pallet in the software so the system can track its life in your business. When there is a loss, theft or breakage, you should also immediately record these updates. Any business can use a periodic system since there’s no need for additional equipment or coding to operate it, and therefore it costs less to implement and maintain.

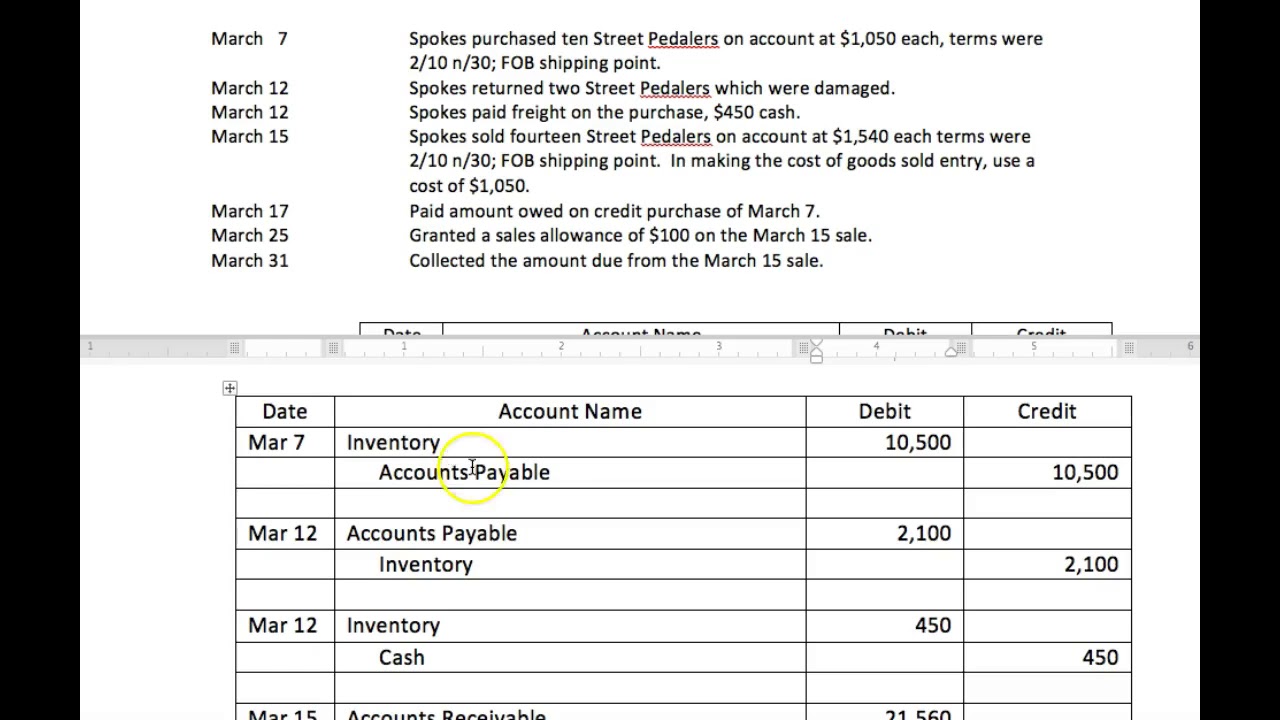

Journal Entries

It is the temporary account that will be reversed to zero on the reporting date. Some companies put it under the inventory sub-account, however, we can put it in any account as it is just a temporary account. Below are the journal entries that Rider Inc. (the sporting goods company) makes for its purchase of a bicycle to sell (Model XY-7) if a perpetual inventory system is utilized. A separate subsidiary ledger file (such as shown previously) is also established to record the quantity and cost of the specific items on hand. But if a company grows, switching to a permanent system could be necessary since it gives you access to the cost of goods sold whenever you need them. In addition, you may use it to spot any stock flaws and take the appropriate action instantly.

How confident are you in your long term financial plan?

However, companies of all sizes may use the periodic inventory control method. Let us talk about periodic inventory systems and how they might aid with inventory control. Square accepts many payment types and updates accounting records every time a sale occurs through a cloud-based application.

- A perpetual inventory system automatically updates and records the inventory account every time a sale, or purchase of inventory, occurs.

- However, the sheer volume of transactions in some merchandising businesses makes it impossible to use anything but the periodic system.

- Its journal entries for the acquisition of the Model XY-7 bicycle are as follows.

- The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method.

- The system is also less flexible than other types of inventory systems, which can make it difficult to adjust to changing inventory needs.

This inventory valuation method is possible through point-of-sale (POS) systems and radio frequency identification tags tied directly to accounting software packages. The perpetual inventory method automatically and continuously records purchases and sales as they happen and updates the inventory account. Regardless of whether we have return or allowance, the process is exactly the same under the periodic inventory system. Both returns and allowances reduce the buyer’s debt to the seller (accounts payable) and decrease the cost of the goods purchased (purchases). The buyer may want to know the amount of returns and allowances as the first step in controlling the costs incurred in returning unsatisfactory merchandise or negotiating purchase allowances.

The gross profit method is an estimate of the ending inventory in the period. You can use this in the interim period, the time between physical counts, or to estimate how much stock you lost in the case of a catastrophic event. Accountants do not consider it as an airtight method to determine the annual inventory balance, as it is not precise enough for financial statement reporting. Companies make any necessary adjustments from purchasing goods to a general ledger contra account.

Sales will close with the temporary credit balance accounts to Income Summary. Using the purchase transaction from May 4 and no returns, Hanlon pays the amount owed on May 10. When merchandise is purchased, the cost is not debited to the Inventory account, but rather to another what is an accrued expense square business glossary account called Purchases. Under a periodic inventory system, any change in inventory is recorded periodically, typically at the end of the month or year. The total of the beginning inventory and purchases during the period represents all the firm’s goods available for sale.

This is the same as the entry made when there is a sale; however, this transaction does not “match up” with any particular sale. Further investigation would take place if the amount of the shortage was significant. A merchandising business buys product from vendors, marks it up, and sells it to customers. For many small businesses, this method is a perfect solution and makes a lot of sense.